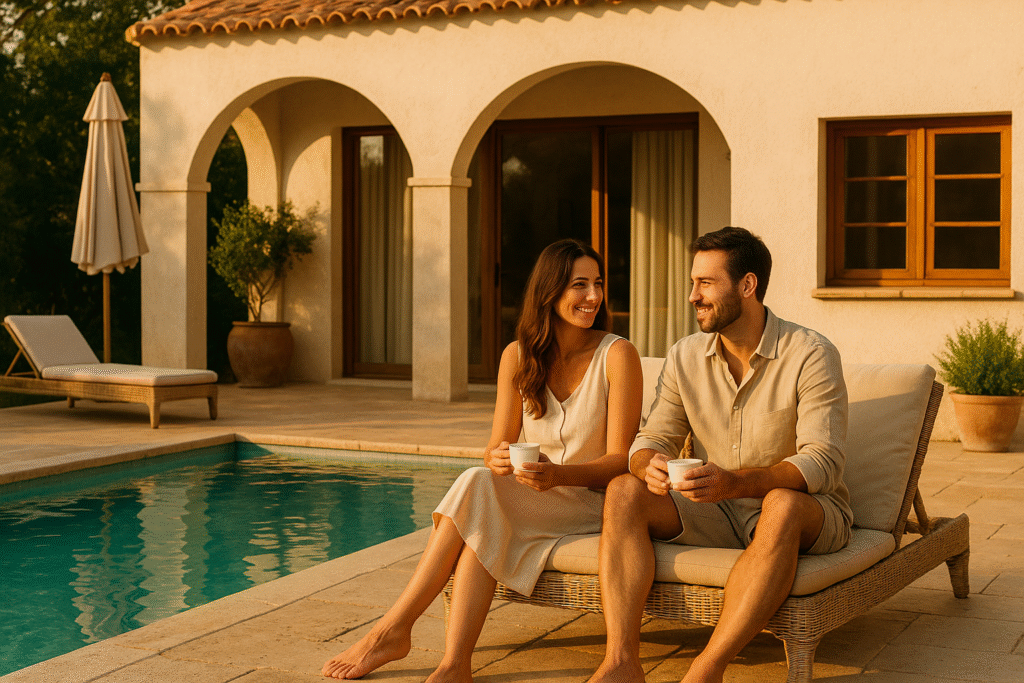

The hospitality world is shifting. Boutique villas, private homestays, designer bungalows, and curated escapes are now being chosen over traditional hotels. Guests today look for something more than a stay — they look for comfort, privacy, and care.

And with this change, the responsibility of the host has also become more complex. The risks are no longer limited to property damage alone. Guest well-being, staff safety, weather patterns, and experience continuity now play a crucial role in how hospitality businesses must protect themselves.

This is where the new era of hotel and villa insurance comes in.

More Personalized Insurance, Less One-Size-Fits-All

Earlier, most property owners would simply buy standard commercial property insurance. But every villa has its own personality and risk profile — a beachfront villa in North Goa doesn’t face the same risks as a glass-facade hillside villa in Lonavala.

This is why the industry is moving toward custom-shaped insurance coverage, designed after considering location, architecture, number of rooms, guest footfall, presence of a pool or lawn, and even the style of hosting.

Hospitality insurance is becoming tailored — just like the experiences we offer guests.

Climate-Aware Coverage is No Longer Optional

Weather patterns are unpredictable today.

Heavy showers, salt-air corrosion, damp walls, fallen trees, and seasonal floods are now frequent claims across villa and resort regions.

Insurers are adapting, and weather-linked protection is gradually becoming standard — especially in Indian regions like Goa, Alibaug, Karjat, Lonavala, and Kerala.

Properties near beaches, lakes, rivers, cliffs, or lush forest valleys will increasingly require climate-ready insurance — not just standard property coverage.

Liability Protection Will Be a Core Layer of Safety

The biggest risk is not the building — it’s the people inside it.

If a guest slips by the pool, if luggage gets damaged, if a staff member gets injured during work — the financial and legal implications can be heavy.

This is why Guest Liability and Staff Liability will no longer be optional add-ons. They will become fundamental to any hospitality insurance plan. It also builds trust — guests feel safe in a property that is backed by responsible hosting.

If a guest slips by the pool, if luggage gets damaged, if a staff member gets injured during work — the financial and legal implications can be heavy.

This is why Guest Liability and Staff Liability will no longer be optional add-ons. They will become fundamental to any hospitality insurance plan. It also builds trust — guests feel safe in a property that is backed by responsible hosting.

Claims Will Become Faster, Digital, and Hassle-Free

The slow, paperwork-heavy claim processes are being replaced.

Expect quick video surveys, WhatsApp-based documentation, and online approval tracking.

This means:

Less downtime

Faster repairs

No unnecessary follow-ups

In short, the claim process will finally match the pace at which hospitality operates.

Insurance Will Become Preventive, Not Just Protective

Insurers are not just paying claims — they are helping owners avoid them.

This includes:

Periodic property health check-ups

Pool and deck safety guidelines

Electrical and fire risk audits

Staff training and safety briefings

This shift reduces claims and keeps the premium stable over the years.

Insurance is slowly becoming a partner in the care and upkeep of your property.

Staff training and safety briefings

This shift reduces claims and keeps the premium stable over the years.

Insurance is slowly becoming a partner in the care and upkeep of your property.